In the past year, many people have been drawn into the Non-Fungible Token (NFT) collectibles, art, music, digital real estate, or digital fashion because they can relate to it. A lot more than with the start of bitcoin. However, a large part of the billions in trading is done by only a very small group, and NFT trading is anything but mainstream.

What Is a Fractional NFT?

A fractional NFT is simply a whole NFT that has been divided into smaller fractions, allowing different numbers of people to claim ownership of a piece of the same NFT. The NFT is fractionalized using a smart contract that generates a set number of tokens linked to the indivisible original. These fractional tokens give each holder a percentage of ownership of an NFT, and can be traded or exchanged on secondary markets.

Non-fungible tokens (or NFTs)are ERC-721 tokens created by an indivisible smart contract on the Ethereum blockchain. Since the tokens are indivisible and impossible to replicate, they are the perfect medium for individual intellectual property tracing.

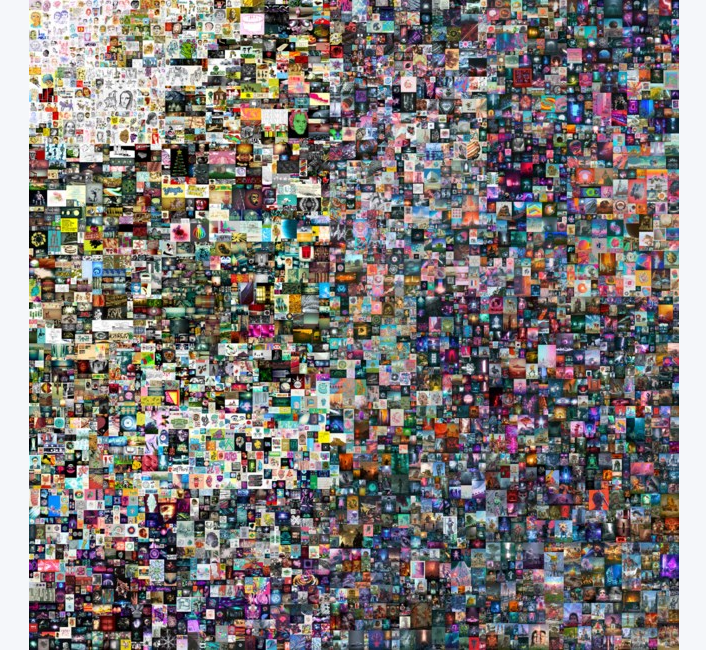

NFT assets experienced a meteoric rise in 2021 thanks to multiple record-setting auctions of NFT projects. These virtual assets run the gamut from digital art, in-game items, virtual real estate and countless others.

So far, the largest was the auction of digital artist Beeple’s work Everydays: The First 5000 Days, which sold for $69 million at Christie’s auction house in February 2021. That historic sale opened the door for several more NFT projects, including NFT avatars by CryptoPunks and Bored Ape Yacht Club, some of which are now trading for millions of dollars on secondary markets.

Making NFT Ownership More Accessible

As a burgeoning asset class, NFTs have greatly increased in popularity. Some collections have become so valuable that the price of owning a single NFT has become prohibitively expensive. While not every NFT collection has acquired the infamy of Beeple’s art or cartoon ape avatars from Bored Ape Yacht Club, the ones that are worth collecting can still be quite pricey. It also doesn’t help that NFTs are one-of-a-kind tokens, which means acquiring them on crypto markets can be difficult, due to a lack of liquidity.

With such high barriers to entry, fractionalization is a potential solution to all of these problems. Breaking down an NFT into smaller pieces democratizes this new market, allowing interested parties with limited funds to affordably invest. This not only benefits investors, but also NFTs in general, because it brings liquidity to the market. Fractional NFTs inject the market with a large number of affordable tokens that offer percentage ownership of popular NFTs.

Essentially, buyers with limited funds are able to buy fractional NFTs for a small proportion of the total market value. This enables multiple investors to each gain partial ownership of the same asset.

The news about the million-dollar NFTs is mainstream, but the actual trading is not yet. So far, there have been three types of people buying NFTs. The speculators – the smart people, the insiders – who make all the money. The show-offs – those who want to show off that they are rich and can afford a Bored Ape, and the people who got in late and are trying to convince you to buy their NFT because they don’t want to lose money. However, this will change as the metaverse comes to life and NFTs hold actual utility.

Traditional Gold Rush

The 2021 NFT hype is a traditional gold rush, but the hype is different from the ICO hype in 2017, which involved many scams raising funds from consumers driven by Fear Of Missing Out (FOMO). While there are certainly plenty of scams with NFTs, as we will see, with NFTs eventually offering real utility, speculation and extreme prices will likely disappear for the vast majority of NFTs simply because NFTs will become ubiquitous

One of the great things that has come out of the NFT frenzy, though, is that for the first time, digital artists can get paid for their work and contribution to society. However, that does not mean that NFTs are without challenges. In fact, there are plenty, and if you are interested in minting or trading NFTs, it is to be aware of them.

More accessible assets

Accessibility is one of the major benefits of NFT fractionalization since it’s more affordable for investors, thus reducing the barrier to entry for owning certain assets.

The collective ownership that comes with fractional NFTs allows a group of investors to own assets with traditionally high barriers to entry. For example, owning real estate or art pieces requires investors to meet particular requirements, whether a certain level of net worth or certain legal requirements.

The mechanics behind fractionalization are pretty simple: Take a whole NFT and create a set number of shares (1,000, 10,000, even 10 billion) which are sold at a fixed price. These shares can be bought and sold on secondary markets without affecting the value of the original NFT. A famous example of fractionalization within this space is the sale of NFT art by musician Grimes called Newborn 1 & 3, which was auctioned on Otis in July 2021 with prices starting from $10 per share.

Recent: Gym owners aim to bring NFT memberships to wellness clubs

By using fractional NFTs, these hurdles could potentially be bypassed by the average person. Alexei Kulevets, co-founder and CEO of Walken — a move-to-earn blockchain game — told Cointelegraph:

“No matter whether you are a builder, a collector, or a consumer, with fractional NFTs, you can co-own any fragment of an art piece or an NFT project you work on. Or, it could be something entirely different, where ownership is verified by an NFT (e.g., real estate). Think of it as an exchange-traded fund, only without intermediaries and management fees. I think it’s a beautiful concept, fully worthy of being called the new era of the internet. The era of co-creating and co-owning.”

Joel Dietz, CEO of MetaMetaverse — a metaverse creation platform — echoed the sentiment, telling Cointelegraph, “It makes it easier and, more importantly, accessible. Asset fractionalization isn’t new, but it entered the NFT space not that long ago — one aspect is to make expensive tokens more accessible to different investors with different appetites — it makes it easier to set the price for NFTs and even unlocks monetization opportunities via DeFi platforms.”

This accessibility could also bring additional investors into the blockchain space, Asif Kamal, founder of Web3 fine art investing platform Artfi, told Cointelegraph.

Another famous example is the sale of an NFT of the iconic “Doge” meme that led to the creation of the meme cryptocurrency Dogecoin. An NFT of the meme sold for $4 million in June 2021 (it’s now valued at several hundred million dollars). The buyer, a collective known as PleasrDAO, fractionalized the NFT 17 billion times, allowing anyone to own a piece of it for just pennies.

“Fractional ownership is the way forward to enhance the size of the market massively and helps adoption and accessibility to a much wider audience to invest in the asset class more simply and in a much easier way,” he said.

What are the use cases?

Real estate is a popular use case for fractional NFTs, and the underlying blockchain technology provides an additional layer of transparency. For example, users can view previous buyers and investment activity via the blockchain explorer.

Dietz said, “The usual case that everyone’s quite keen on right now regarding Fractional NFTs is the potential for an individual to transfer ownership of real estate (an IRL asset) — storing the information on the blockchain and it transferring seamlessly and immutably.”

“Owning a fraction of an NFT that represents a real-world asset, investors can cash out of their crypto holdings without ever leaving the decentralized finance ecosystem entirely. Now, the hype focuses on real estate, but these fractionalized high-involvement goods could be very interesting in the manner of watches, paintings, boats, planes and more,” he continued.

Play-to-earn gaming is another use case for fractional NFTs, enabling multiple players to purchase expensive in-game assets collectively. In-game NFTs can become very expensive due to demand, and enabling players to split the cost can make it easier for them to use those same assets. For example, the P2E NFT game Axie Infinity is currently testing the idea of fractionalized NFTs by selling fractions of the rarest Axie NFTs.

Why Are Fractional NFTs Necessary?

There are three core reasons why F-NFTs are needed:

Democratization: The exorbitant prices of some NFTs can prevent smaller investors from participating. Fractionalizing an expensive NFT lowers ownership costs and makes it more accessible to a broader range of investors. It’s important also to note that when the price of an NFT rises, then the value of all of its fractions increases proportionately. If its value unexpectedly tanks, which is common in the crypto market, then the value of all the fractions go down as well.

Price discovery: Fractionalized NFTs can provide price discovery mechanisms that determine how much a particular NFT is worth. Since the fractionalized ERC-20 tokens are sold on the open market, their prices can help provide a reasonable valuation of a tokenized asset’s price.

More liquidity: The biggest defining feature of NFTs is that they’re one-of-a-kind tokens which can’t be replicated or divided. This uniqueness limits access to NFTs, especially valuable ones, to only a few wealthy investors. F-NFTs address this lack of liquidity, since the ERC-20 tokens can be easily traded in secondary markets. Instead of waiting for weeks or months for one NFT to sell, numerous investors may be more willing to buy up fractions of an NFT immediately, at a reduced price, thereby addressing market liquidity issues.

5 Challenges of NFTs

NFTs seem to solve digital ownership, but, as of yet, most NFTs do not consider copyright, actual legal ownership, piracy, theft or other human problems.

1. Who Owns the Underlying Asset?

NFTs prove that you own something that is hosted somewhere, but that does not mean that the underlying asset is truly yours. What NFTs address is that it shows that you made a transaction for a certain digital asset, so it is a verifiable receipt that indicates that you own the asset.

The actual NFTs – as in the actual digital artwork – are, ideally, stored on a decentralized file-sharing system such as IPFS, FileCoin or Storj, but they can also be stored on a central server such as AWS as it is often too expensive to store a large JPG, GIF, Video or MP3 decentralized. Instead, often just the web address of where the artwork is stored, is stored on the blockchain. If the items are hosted on a centralized location, the entity that runs that server can simply delete the item, even if you paid millions of dollars for it.

A token is a smart contract pointing to the location of that web address on the blockchain (that points to the server that stores your asset), which is stored in a digital wallet. As the web address is on the blockchain, that cannot be changed, but someone can remove the asset from the server making your immutable and expensive web address return a ‘404 not found’.

Unless your expensive artwork is stored on a decentralized storage system, you might own a receipt of a certain asset, but you certainly do not possess it, and the owner of the server where it is stored actually controls it and can delete it if wanted.

2. Centralization in a Decentralized Ecosystem

Therefore, it would be wise to use one of the well-known marketplaces such as OpenSea, but even that is no guarantee for success. While OpenSea uses the IPFS, since it is a centralized exchange, they also control the keys, similar to any centralized crypto exchange. If OpenSea decides to remove or freeze the digital asset because of a copyright infringement or other reason, your NFT becomes worthless, and this has happened already more than once.

For example, at the end of 2021, OpenSea stepped in to block the sale of stolen, expensive NFTs from collector Todd Kramer, a well-known art gallery owner, reportedly worth $2.2 million. Using a phishing attack, the NFTs were stolen from his hot wallet – a wallet connected to the internet. While it might be nice for Todd that the thief cannot resell his NFTs, it raises important questions about the decentralization of these NFTs.

3. Hacked Wallets and Blockchain Security Challenges

If it is stored on decentralized storage, only the user who holds the NFT should be able to access it and control it. To make matters worse, most NFTs – the pointers to where the asset is stored – are stored on a centralized exchange, which is similar to your crypto stored on a centralized exchange, and this means that if the exchange gets hacked, you can lose your valuable NFTs.

If the NFT is on your decentralized wallet and is on a hot wallet connected to the internet, you are responsible for the security. As Todd Kramer discovered, if you are hacked due to a phishing scam, you can still lose your NFTs.

To make matters worse, NFTs are stored on a blockchain. This can be Ethereum, Solana, EOS or any of the other few dozen blockchains that enable NFTs. These blockchains are kept secure by decentralized miners or stakes, the administrators, and the more administrators, the more secure a blockchain becomes as it becomes harder to perform a so-called 51% attack.

This is an attack where a group of miners hold more than 50% of the network’s hashing rate, and as they control the majority, they can reverse transactions that were completed while the group were in control. Meaning they could double-spend tokens, which is the entire promise that blockchains aims to prevent.

Blockchains that become the victim to a 51% attack will probably not live very long, and if your NFTs are stored on such a blockchain, your NFTs might become completely worthless. Of course, most of the NFTs reside on Ethereum, which has a broad adoption and is truly decentralised due to its age,. However, this comes at a cost as Ethereum’s gas fees, the price that needs to be paid to record a transaction, has gone through the roof, which makes the network prone to inequality to the extent that many organizations have tried to prevent in Web 2.0.

There are also other chains used for NFTs which will be cheaper to use, but these might be more centralized and, therefore, have weaker security. This all means that for NFTs to achieve mass adoption, transaction costs need to go down, ideally to zero or close to zero, while decentralization needs to go up to ensure that an NFT purchased today for $10.000 is still holds value in the future.

4. Fat Finger Mistakes

If you are unlucky, you bought an expensive NFT and either your wallet can get hacked, the security of the blockchain storing the NFT can be breached, or the centralized database storing your actual artwork can be hacked, and the criminal can delete the actual asset, in which case you still hold the NFT pointing to a web address pointing to a server, but since there is nothing on that server, you own nothing.

If that does not happen, then you still have your own responsibility to make sure that when you do sell your Bored Ape, you do not sell it for the wrong price, as happened to NFT owner Max who accidentally sold his bored ape for 0.75 ETH (around $3000) instead of 75 ETH (around $300.000). Before the owner could fix his mistake, a bot had snapped up the unique collector’s item by sending the transaction with 8 ETH (around $34000) of gas fees to ensure it was instantly processed.

These so-called fat-finger errors have happened before. While it is annoying for the original owner, it also shows a bigger problem that has been causing many debates around the world in the past years; net neutrality. The objective of net neutrality has always been to give everyone equal access to the internet and that internet service providers (ISPs) must treat all internet communications equally. Obviously, due to the gas fees, this no longer applies in the world of blockchain, which could pose a threat for the future, further increasing the digital divide and inequality.

5. Scams and Copyright Infringements

Unfortunately, that is not all, there are also plenty of scams and copyright infringements, or some call it satire or art in itself, of famous and expensive NFT collectibles such as the Bored Ape Yacht Club. One example is the Phunky Ape Yacht Club (or PAYC) which simply flipped the right-facing Bored Apes to face left and resold them, making around $1.8 million in the process.

PAYC has since been banned from centralized markets such as OpenSea, Raible and Mintable, which again shows the power these centralized markets have by creating a seamless trading experience for the masses.

Suppose you are lucky, and all works fine. In that case, you are still not yet out of the woods because it might very well be that the NFT you bought does not come with the right IP or copyrights, potentially preventing you from monetizing it and only using it as a nice image to view in your wallet or virtual home, which everyone else can do as well.

In fact, most NFTs sold in 2021 did not come with any copyright or IP, meaning that you cannot monetize the NFT, which is a crucial component for a vibrant economy. The collection of the Bored Ape Yacht Club does as we discussed, resulting in a vibrant community and steep prices, but most collectibles don’t, and all you have is a pointer towards an item stored somewhere, which is not a sustainable solution if NFTs are meant to achieve mass adoption.

Barriers to Adoption

While fractional NFTs may make it easier for people to invest in certain assets, market conditions could potentially interfere with their adoption.

Dietz said, “Given the market right now, though, we’re either going to see more creators and marketplaces utilizing these fractional NFTs and gain popularity through those mediums, but if things don’t change, I doubt fractional NFTs will evolve much further, for now at least. Who knows what the market will look like in the next three months, let alone three years?”

Regulators and lawmakers could also slow down adoption. Since fractional NFTs let people own a fraction of an asset, they could be classed as stocks by the United States Securities and Exchange Commission (SEC).

Yaroslav Shakula, CEO at YARD Hub — a Web3 venture studio — told Cointelegraph, “As an idea, fractional NFTs sound promising, but on a practical level owning them implies certain difficulties, with regulation being the most significant one. Fractional NFTs might be likened to stocks as they also confirm ownership of a share of an asset (NFT, in this case).”

Shakula also says that current legislation is not clear on the legal status of fractional NFTs being used to own a share of physical assets. “In many cases, this type of NFT ownership is not clearly outlined in the legislation, and projects and users have a hard time figuring out how SEC or other authorities will deal with this ownership. So for now, fractional ownership is only valid in certain territories where relevant legislation is in place.”

Shin similarly stated, “The success of fractional NFTs in allowing investors to reap benefits from real-world assets also depends on whether regulations operate in tandem. For example, dissonance will occur if fractional NFTs and traditional title deeds pose competing legal claims to real-world assets.”

Due to the uncertainty behind the taxation and the legal status behind fractional NFTs, temporary ownership could be a safer bet for the short term.

Shakula expanded on this, saying, “At the current point, a much more viable and doable approach is to transfer timeshare/temporary ownership through NFTs. Examples of use cases are the rights to rent a car or stay in a hotel. This way, NFT owners don’t have to decide who pays taxes or who’s handling damage costs. However, until these issues are solved, fractional NFTs look better on paper rather than have common use cases.”

Regulatory concerns aside, some believe that fractional NFTs represent the values of a decentralized internet. Kulevets sees fractional NFTs as a catalyst for Web3 adoption, stating:

“If you look at it closely, fractional NFTs represent the very essence of the Web3 concept. We call Web3 the next era of the internet for a reason: decentralization, security, ownership and creation without intermediaries are among its fundamentals. Everyone who shares the vision, skills and expertise can co-create and co-own the new reality and be a part of many projects.”

The Popularity of NFTs and Barriers to Access

Non-fungible tokens are ERC-721 tokens based on the Ethereum blockchain, associated with a unique, immutable smart contract. The indivisibility of NFTs offers a promising feature for tracing the intellectual property of individuals. Non-fungible assets showcased meteoric growth in 2021 with many record-breaking million-dollar sales of NFT projects.

As a matter of fact, non-fungible tokens are everywhere, starting from digital art and virtual real estate to in-game collectibles and the metaverse. However, the growing popularity of NFTs has fuelled unreal growth in their pricing, thereby making them expensive for average buyers. Therefore, fractional art NFTs and similar use cases can resolve the concerns of accessibility to NFTs.

The division of an NFT into smaller pieces can introduce a democratic approach in the market by allowing many investors with limited funds to gain a share of the NFTs. Interestingly, the benefits of fractional NFTs not only remove the barriers to access to NFTs but also improve liquidity in the NFT market. Fractional non-fungible tokens can introduce many affordable tokens in the market for offering a share of ownership in renowned NFTs.

Can Fractional NFTs Be Reversed?

It’s possible to reverse the fractionalization process and turn a Fractional NFT back into a whole NFT. Typically, the smart contract that fractionalizes an NFT has a buyout option that lets a Fractional NFT holder purchase all the fractions to unlock the original NFT.

Typically, a Fractional NFT holder can initiate the buyout option by transferring a specific number of the corresponding ERC-20 tokens back to the smart contract. This will start a sort of buyback auction, which will run for a fixed timeframe. The other Fractional NFT holders then have some time to make a decision. If the buyout is successful, the fractions are automatically returned to the smart contract, and the buyer gets full ownership of the NFT.

Where Can I Buy A Fractional NFT?

Several platforms have emerged where users can create and purchase fractionalized NFTs, including:

- Otis: Otis is an NFT investment platform where users can invest in NFT collectibles and art, manage their NFT portfolio and participate in real-time trading via the Otis app. Investors can use the platform to acquire fractional interests in crypto assets.

- Unicly: Unicly is for investors looking to transform their NFT collection into a tradable asset with guaranteed liquidity. Investors can use the platform to tokenize NFTs and create tradable collections of any size.

- Fractional.art: Fractional.art is a platform where investors can buy, sell and mint fractions of NFTs. NFT holders can use the platform to create NFT fractions, or to become owners of fractionalized NFT collections they couldn’t otherwise afford.

Are Fractional NFTs a Good Investment?

Fractional NFTs are undoubtedly a good investment. They’re helping to unlock liquidity for NFTs, while also increasing inclusion and participation in the booming NFT space. They expand the NFT market’s new opportunities by bringing liquidity, price discovery and democratization.

That being said, fractionalized NFTs aren’t without risk: They face all of the same issues — such as publicity rights, contracts and intellectual property rights — which plague NFTs in general. Additionally, while the sale and purchase of whole NFTs as digital collectibles may not raise issues with securities laws, F-NFTs are more likely to raise red flags with financial regulators, because their creation could be viewed as unauthorized initial coin offerings (ICOs).

During the Security Token Summit 2021, SEC Commissioner Hester Peirce warned that the agency may consider fractional NFTs to be securities. However, the SEC (US Securities and Exchange Commission) has yet to release any formal legal and regulatory guidelines concerning NFTs.

As the market for NFTs and F-NFTs continues to grow, legal rules around the assets will also evolve. For now, investors and owners in NFT-related ventures should remain cognizant of any legal issues that might arise.

The Bottom Line on NFT Fractionalization

The NFT market continues to explode in popularity and demand and we are certain to see more interesting developments and use cases as blockchain technology evolves even further.

The concept of fractional NFTs is still nascent, but it looks like it’s going to be the next big trend in the ever-growing crypto industry. NFT fractionalization enables greater liquidity and by extension endless possibilities for investment strategies. It opens up the market to a significantly wider pool of investors, ensuring that the next wave of monetization of digital assets will be powered by F-NFTs. To find out more about investing in NFTs, find out about how NFT loans work or NFT staking.